Mobile Home Occupants Insurance Policy You can choose to pay month-to-month or conserve cash by paying for the entire year in one easy payment. Under a cash money payment policy, the plan will pay the actual cash worth of the thing as if valued today. Under a replacement policy, the policy will certainly pay for the price of a replacement. These three elements are one of the most essential for safeguarding your service and your future, so they are what you ought to ensure is included. Without this sort of security, the landlord can be sued directly as a specific, and that could cause much larger problems for every person entailed. By complying with these guidelines, property owners can guarantee renters are protected while decreasing any possible dangers on their own. While no state mandates mobile home renters insurance policy, a proprietor could require you to lug mobile home occupants insurance coverage as a problem of the lease. That's why it's important to contrast proprietor insurance policy estimates from numerous insurance companies. One more distinction between property owner insurance policy and house owners insurance coverage is price. Landlord insurance policy typically sets you back more than property owners insurance. If you're fixing damage and currently need to meet higher building regulations, optional insurance Commercial Auto Insurance in La Puente, CA policy coverage can link the expenses for the better repair services. Home owners insurance coverage can only be held by the homeowner while occupants insurance coverage can only be held by the tenant of a rental building. There are even instances where both the occupant and proprietor will need to safeguard themselves. If a third-party obtains wounded on an unshoveled sidewalk, for instance, both events are most likely to have some type of obligation, and their insurance plan would aid cover that We are of the opinion that the best method to guarantee that all parties are secured is to encourage or require your lessees to have rental insurance coverage while additionally lugging property owner insurance yourself. Certainly, the specifics of what is or is not covered under the rental insurance that your renter has is mosting likely to depend upon their policy. Recommend your lessee to look very closely at their terms or call their insurance provider to learn more. There are circumstances where you or your tenant may discover that they or their insurer needs to file a claim against the contrary event.

What Property Manager Insurance Doesn't Cover

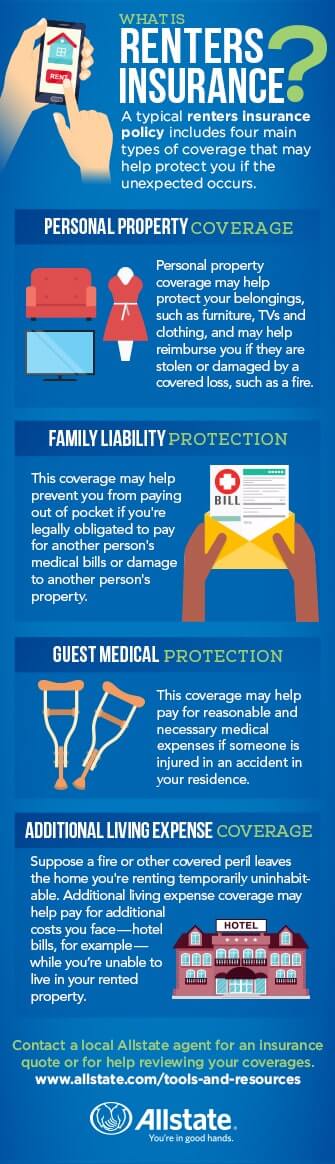

Mobile home tenants insurance is a sort of occupants insurance policy that you get if you're leasing a mobile home. It supplies the exact same coverage that any kind of renters insurance plan provides. The nationwide ordinary expense for $350,000 well worth of home owners insurance protection is $1,582 each year, according to a Forbes Advisor evaluation of home insurance costs. Utilizing the 25% price quote offered by Insurance Information Institute would certainly put the average property owner insurance for the very same protection at nearly $2,000 each year. If a friend rolls an ankle due to the fact that they stepped on your pet dog's chew plaything, you can be accountable for the clinical costs. However if you have renters insurance coverage, the responsibility component of the policy will cover that.- You can buy up to $100,000 in insurance coverage to shield your prized possessions through the National Flooding Insurance Policy Program.Occupants Insurance policy can safeguard your valuables, such as laptops or jewelry from burglary or damage.Once your occupant submits their evidence of plan, we will send you an email allowing you recognize that your lessee is covered.If an accident takes place and you are without responsibility insurance policy, you can be on the hook for clinical expenditures, building damages repairs and legal prices.

A Win-win For Renters And Landlords Alike

If you leave the cooktop on and accidentally start a fire or leave the water running and damage the floorings and walls, the landlord or their insurer may sue you. If you do not have insurance coverage to secure yourself, you may wind up with an enormous bill to foot. This is where the personal responsibility security section of renters' insurance policy comes in. We will compensate for such damages under the cover against all-natural forces. When you return home from a journey, you see that your home has been broken into. As an example, if an electric device breaks down because of a brief circuit, we will compensate for the harmed device. By attending to issues quickly, you decrease the probability of a lawsuit. If a renter sues you and can show that they communicated their issues to you, yet you disregarded to resolve the situation immediately, resulting in an injury or damage, you could be held liable.A Landlord’s and Renter’s Guide to Dealing With Natural Disasters - Avail

A Landlord’s and Renter’s Guide to Dealing With Natural Disasters.

Posted: Mon, 07 Feb 2022 08:00:00 GMT [source]